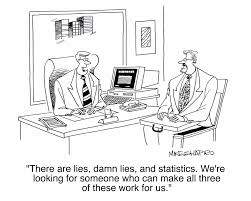

Eps 8: Lies And Damn Lies About FINANCIAL ADVICE

| Host image: | StyleGAN neural net |

|---|---|

| Content creation: | GPT-3.5, |

Host

Ernest Price

Podcast Content

In my experience, numbers are not facts and we shouldn't treat them as such. This is a long way to go to my point and to quote: sometimes we can go too far with statistics - just remember that a lot of what you see in the diagram can fall into the category of lies, damn lies - and statistics.

At times like this, we think it is helpful to understand what is “normal” in relation to market cycles. Finance and investing face a thousand physical challenges which makes it particularly unrewarding to compare two different time periods on a chart.

Because we learn by visual means, graphs and charts can help to make complex statistics into an easy-to-understand concept. And when you don’t know what is included and then, by definition, what is excluded, you can come to the wrong conclusions and thus wrong decisions. Fortunately, industry data can be an ally that creativity needs : more data can be combined with more powerful computers to pervert the scientific process of how we learn things in finance and beyond.

The result is countless, often subtle, causal correlations in disguise in investment strategies offered by financial advisors, banks, and investment firms. For example, a friend told me recently that his financial advisor advised him to invest in a factor investment product and a few days after that unfortunate outcome, his advisor showed him another set of backtests and statistics for another fund he should consider. What happened here is that someone took a valuable statistical tool and went too far.

By blindly using it out of context, you do yourself a disservice. Apart from this post and perhaps equally important, it is important to understand better the context of the data, but I am also extremely suspicious of the careless or intrusive use of numbers.

But there are some notable statistics, some of which are proven, as well as rules of thumb that govern profitable and successful clubs. For the clubs they own for profit, this margin is doubly important for the same financial reasons and their return on equity. There are some very efficient and busy clubs with a daily rate that often earn 30% or more.

It is the same with roulette or craps gambling systems, although in the end these systems may lose less money than the mall's "investment advisor" if you really need to invest and look for fences , then use the 5% rule outlined in the article “Play the Market as a manager. Hedge Fund. “ As a financial advisor your clients depend on you to eliminate noise, find a signal and convince them of your findings.

Based on over 25 years of experience in the infrastructure industry in projects with public and private funding, yes, we are now safeguarding public banks and taxpayers in countries too big to fail. If someone can provide substantial and meaningful evidence to the contrary, then they can obviously be persuaded to share my beliefs with the network adapter.

Indeed, in today's crazy headline environment the same report will be used to support both bullish and bearish perspectives on CNBC. While many people panic over the impact of the coronavirus, this graph shows how previous pandemics have correlated with market returns. As you can see, markets react in the short term to noise and rally after news of deadly diseases.

In this article we will see how the use of a weapon-quality chart can create a negative emotional reaction to one of the worst stock market events in history... The market will go down again, it will go up and down again, and again... until it peaks and falls again as it has since the founding of the stocks markets.

It is sometimes used colloquially to question the statistics used to prove an opponent's position of view. An anonymous source from an 1891 question in the notes and queries refers to varying degrees of falsehood, from lies, lies, and worse, statistics. It has been attributed to a variety of people, including Mark Twain, but the truth is that no one knows who said it first.