Eps 1: High tech Investment in the Arab world

Mubadala, Abu Dhabi's state investor, announced on Monday two new MENA tech funds that will invest $250 million in start-ups from the Middle East region.

"Over the next 10 to 20 years you will see great global technology companies that have started from the region," said Ibrahim Ajami, Head of Ventures at Mubadala Capital, in a CNBC interview Monday.

States like Abu Dhabi and Dubai in the UAE, as well as other countries in the Middle East, are increasingly pumping funds into local tech ecosystems, in part to help reduce their reliance on oil-dependent industries.

Host

Miriam Lucas

Podcast Content

But technology - identified as a major driver of growth that creates much - needed employment opportunities for the region's growing young population. Abu Dhabi and Dubai have set the pace in creating an ecosystem that nurtures entrepreneurial talent and enables young businesses to grow. The Syrian entrepreneur in Dubai, who developed the world's first high-tech taxi service in the Middle East, and a former McKinsey employee from the United Arab Emirates, who created a booming ride-sharing business, have cemented the Gulf as a desirable foreign investment zone.

In a move that will create thousands of jobs, Amazon Web Services has chosen Bahrain as the location for its first U.S. office in the Middle East, in Bahrain. Increasing foreign interest in technology - resident companies and high-tech startups - is the result of increased foreign investment, and it brings its own economic benefits.

Most countries now have clusters of startups brought together by foreign investors, many of whom have links to accelerators, incubators, and investors. Such spending, coupled with the high cost of living and lack of access to high-tech capital, has led to fears of a bubble. Last month, the US Chamber of Commerce for the Middle East and North Africa hosted the first ever high-tech startup summit in Bahrain.

Abdelhameed Sharara, who launched the event in 2013, said he was motivated by the failure of the "Arab Spring."

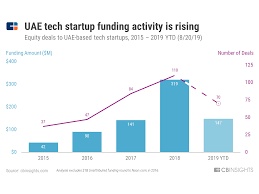

According to Dubai - based on Magnitt, a crunchbase - a data startup that provides venture capital information to startups in the Arab world [1], transaction volume increased by 80 percent, or 3 percent, to 366 transactions in 2018. Two startups come to mind in particular, but they also represent a significant part of the financing for MENA startups (see chart above). Total capital invested across the region amounted to an estimated $793 million2, more than half of which went into seed and early-stage start-ups.

ArabNet is a hot place right now to meet other techies and investors in the Middle East, "says an American working for a Qatar-based technology firm. Dubai-based start-up Careem has also attracted attention in recent months amid rumours that the company is in takeover talks with its US counterpart Uber.

But for tech investors looking at the longer-term picture, even countries whose economies have been scratching their heads since last year's revolution are fertile ground for venture capital firms.

Saudi entrepreneurs are already using technology in their businesses, "says Al-Awami, and a Cairo venture capital firm called Sawari Ventures agrees. The company has set up a tech incubator in Cairo called Flat6Labs to make it easier for young entrepreneurs to start tech companies in Egypt.

Al-Awami cites the Noon Academy as an example of one of the fastest growing tech startups in Saudi Arabia, with more than two million students enrolled. According to the World Bank, there is high demand for education in the Middle East and North Africa (MENA) region.

This year, tech startup Noon Academy raised $8.6 million in its first round of funding. The company was selected as one of the top 10 tech startups in the Middle East and North Africa (MENA) region and has raised $7.5 million of its $10 million Series B investment this year.

One way for Saudi Arabia to achieve this goal is to use technology for small businesses, the entrepreneur said, adding that technology attracts investors and also increases employment opportunities and increases the competitiveness of SMEs and businesses.

While the United States and Europe are likely to be the main markets for Ayoub's technology, he hopes that other countries, such as those active in biomedical research, will also show interest. The kingdom has established a number of high-tech partnerships with companies in the Middle East and North Africa, to name just three. This is actually one of the longest - long-standing - investor relationships in Saudi Arabia, "he said.

Ayoub has met with other Arab-Israeli entrepreneurs to encourage them not to give up on their dreams and to pass on advice and guidance. There are not that many Arab entrepreneurs, but the number is growing fast, "he said, pointing out that venture capitalists are missing a huge opportunity by not investing more in the sector.